Services

Services we offer

Industrial Machinery

supply

Industrial Equipment

supply

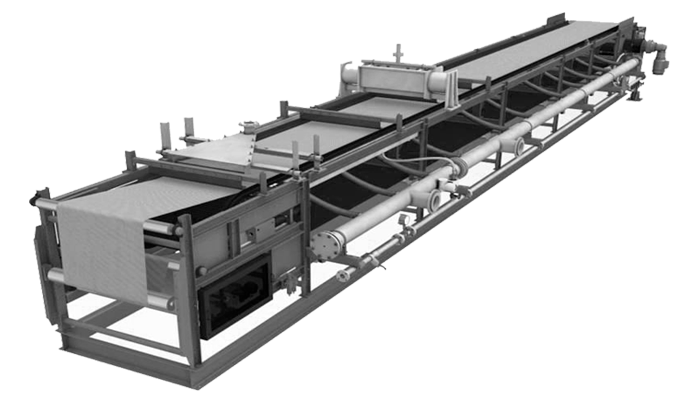

Vacuum Belt Filters

supply

Ball Valves

supply

Spare Parts

supply

Maintenance Service

teardown, inspection, repair

About Us

Professional Staff

Reputation

UltraForm OÜ has been supplying industrial equipment and machinery for several years. During this time, we have earned a reputation for providing only premium products and services. As a one-stop supplier for a variety of industries, we thrive in our business with supply agreements with a wide range of international manufacturers of equipment, industrial automation products and services.

Global expertise

UltraForm OÜ brings its global expertise in industrial equipment supply and automation solutions to our customers all around the world. Our broad foundational knowledge of these markets has positioned us as a leader amongst our peers and we are proud of our ability to meet all the service, repair, and supply needs of our customers.

Look to the future

At UltraForm OÜ, our history is the foundation of our global expertise and success, but throughout our history we have always looked towards the future to remain on the leading edge of the best technology and methods best suited to serve our customers. Our dedication to supplying premium service, at a reasonable cost, has established our global reputation for supplying premium products backed up by quality service.Why Choose Us

Other Services

UltraForm OÜ offers a full range of products and services - from the supply of industrial equipment and machinery to the supply of components and maintenance.

UltraForm OÜ guarantees that it will always be able to offer you the necessary components and services exactly when you need them.

Together we are creating extraordinary technologies that open access to energy for the benefit of all.

The main goal of our company is to provide the customer with the necessary answers and repair services quickly. UltraForm OÜ lacks a complex multi-level control system, which guarantees a high speed of making optimal decisions for you. We will be happy to help you at any time and are always ready to cooperate!

We supply basic equipment, consumables and hard-to-reach parts of critical components. We understand the importance of minimizing downtime and guarantee compliance with deadlines.

We have always built our business around our customers and their endeavors; they are at the center of everything we do.

We work on the most complex and urgent tasks of the industry in order to anticipate the needs of our customers and meet them.

We want to be their performance partner of choice.

To achieve this goal and deliver the best results, we must combine our unique talents and our collective expertise—not just within UltraForm OÜ, but by working closely with our suppliers, contractors, and business partners.

Our industry has an important role to play in the global energy transition, and UltraForm OÜ is developing for this exciting future. We are following transition technologies that will help reduce the carbon footprint and accelerate the path to net zero.

Advantages

- 24 hours a day, 7 days a week engineering support;

- special tools;

- availability of spare parts;

- own off-road vehicles;

- extensive work experience;

- responsibility;